Contents:

Thank you for giving your answers, Why not to share this page to your social profile to appreciate our Efforts. One of many possible things to focus on is the interventionist policy of the government, especially the central bank. More details with entry level + Targets + Stop loss and Global Currency Tips on USDJPY, GBPUSD, GBPJPY, AUDJPY for our Members by SMS. Fundamental analysis is mostly about being aware of upcoming news events, and reacting quickly to the unscheduled ones.

EUR/USD Technical Analysis: With its Highest Test in a Year – DailyForex.com

EUR/USD Technical Analysis: With its Highest Test in a Year.

Posted: Thu, 27 Apr 2023 09:00:35 GMT [source]

It begins with deconstructing the pattern underlying the trend and then extrapolating it. Let me first address the basic premises on which technical analysis is based. Technical analysis remains the same irrespective of the markets you apply to. The analysis and discussion provided on Moneymunch is intended for educational and entertainment purposes only and should not be relied upon for trading decisions. Moneymunch is not an investment adviser and the information provided here should not be taken as professional investment advice. The commentary on Moneymunch reflects the opinions of contributing authors who are certified or otherwise.

I had written “We expect here drift down to 1.3570 – 1.3556 – 1.3500 and more.”

When prices stray from this safe zone or from the moving average line a trader should begin to consider potential entry points into the market. For example, a price that has risen above the moving average line typically implies a market that is becoming more bullish, traders are on the up, and with such will come good opportunities to buy. Just the opposite, when prices begin to fall below moving average lines the market is becoming visibly bearish; traders should thus be looking for opportunities to sell. One rule of thumb for determining where a market or security will meet with either support or resistance on the charts is to find previous chart areas where consolidation has occurred. This, of course, does not necessarily mean the former area of consolidation will prove impenetrable; to the contrary, it will probably be overcome eventually.

Another strong buy signal was given in November 1999, when the 30-day average crossed the 60-day average. It soon starting curving over, however, and the price line began a prolonged sideways movement into the year 2000. The next formal sell signal was flashed in September, at which time the 60-day average crossed over the 30-day average.

Again, it’s time to cut your losses, secure your profits, or this time, long the market. Forex Duniya is a drive for the youth who are keen to learn about the forex market and want to succeed financially in the same. We offer a comprehensive course especially designed for someone who wants to start from scratch and would want to make profitable trades consistently. This is the most common myth about technical analysis that technical analysis is only appropriate for intraday traders or short-term traders. Technical Analysis existed way before computers were common and many successful investors have openly accepted the use of technical analysis for long term investments.

CURRENCY FORCAST

next of kin analysis fails when traders fail to consider the fundamentals. Fundamental factors such as political events, a hike in interest rates, unemployment rates and so on will impact the Forex market more substantially than perhaps any other market. Fundamental factors are often the driving force of major price movements. A trader focused on technical analysis cannot ignore Non Far Payroll on the first Friday of the month and expect his or her technical indications to be as accurate as the day prior. Purely technical traders understand that certain political factors throw all other price forecasts out the window.

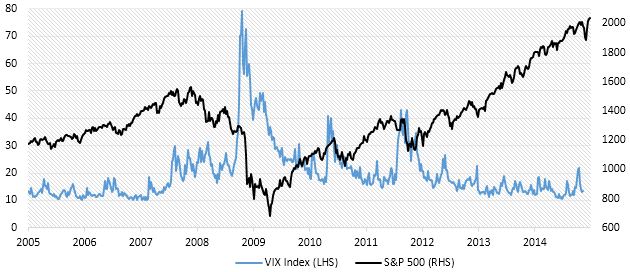

Technical Analysis is commonly and widely used by Equity traders, Forex traders, Commodity traders around the globe to predict the market for short term as well as long term. The tools of technical analysis are useful in examining how the demand and supply for particular security would affect the fluctuations in price, volume as well as implied instability. It works on the assumption that historical activity of trading and changes in the price of the security could be used as valuable indicators. These indicators may help in assessing the movements of price in the future when combined with appropriate rules of trading or investing. The parabolic stop and reverse is a forex indicator used by forex traders to arrive at the direction of a trend, assess short term reversal points of a price.

CHARTS

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Yes, Forex trading is definitely worth learning when it comes to investing. Currently, forex is the most liquid market in the world with an impressive turnover of more than $6.6 trillion per day. This is a big boost from 2016 at $5.1 trillion, proving that this niche is growing substantially.

Flags & Pennants Flags and pennants are perhaps the most common of continuation patterns. Spotting a flag or a pennant usually begins with noticing the flag pole, or for more practical purposes, the trend line. Flags and pennants typically form after a substantial trend up or down as an indication that the price is consolidating, or being tested before continuing in the initial direction of the trend. Though both flags and pennants indicate a continuation of the current trend, there is a distinct visual difference between the two. The flag will be represented by a more rectangular consolidation period, both support and resistance levels will be about an equal distance from one another.

The moving average is one of the best forex indicators that every trader should know. There are those who believe that price movement is completely random and completely unpredictable. However, the true fool would be he or she that ignores the power of technical analysis, particularly in the Forex market. Experienced traders know how to turn a high probability trade into short-term profits, regardless of whether the market is moving up or down. The ability to make money in any market is one of the most significant benefits of CFD and Forex trading. Fundamental trading is also better for position traders who keep trades open for more extended periods.

EURUSD Technical Analysis – ForexLive

EURUSD Technical Analysis.

Posted: Fri, 28 Apr 2023 10:41:00 GMT [source]

When new candles push significantly through this average in conjunction with a sharply angled moving average line it is time to consider an entry point. History has proved itself; when prices begin trading above the moving average line the market is becoming bullish and traders should be looking for buy entry points. When prices begin trading below the moving average line the market is becoming bearish and traders should look for an opportunity to sell. Moving Averages Most literature written on technical analysis, more specifically technical indicators, begins with Moving Averages.

Technical Analysis in Forex Trading

As is the case with trading moving average crosses, buy and sell signals derived from a MACD will come from the crossing of two lines. However, these two lines are not your two EMA lines, rather one is the combined level of the two EMA lines and the second is the signal, or trigger line . The MACD crossing the signal line from above would indicate a buy order and conversely the MACD crossing the signal line from above would indicate a sell order.

If enough human beings believe in the same indicator and the same time frame for that indicator, often there is no better way to go than with the crowd. Market sentiment when shared by the masses most often becomes market reality. That is why an untrained trader often finds him or herself baffled by a price move that does not make any logical sense.

Technical analysis is used by all types of traders and investors on all time frames from a 1-minute chart to a monthly chart. The ultimate advantage of technical analysis is that it helps the traders and investors to predict the future of the market and make investment and trading decisions based on the analysis. The market usually has three trends namely Up Trend, Down Trend, and Sideways or Ranging Market and these trends are easy to predict with the help of technical analysis. They aim to predict future market movements and help a trader to be oriented in the market. There is a very large range of indicators which are used by the traders for forecasting the market.

The greater the congestion, the greater the effort required to overcome that congestion, whether it is in the form of support or resistance. Thus support and resistance serve as checks in the development of a trend to keep the trend from moving too far, too fast and thus getting out of hand and eliciting violent reactions. (This does not apply, of course, in market crashes or “buying panics,” in which case support and resistance levels become meaningless. But such instances are fortunately quite rare. If fundamental traders focus on news events, technical traders concentrate on reading price charts.

The chart provided on the next page for China dotcom Corp is a great example of how a moving average system can serve to protect traders from adverse moves in the stock market. After an extraordinary advance from its initial public offering in July 1999, CHINA proceeded to rise to a price of nearly $80 a share in March 2000. The large gap between the price line and the moving averages that occurred in March was a preliminary warning that the stock was due a significant pullback. Whenever it becomes plainly evident that there is a wide separation between the moving average and the price line, the trader should prepare to either sell or sell short. Notice also how both averages – particularly the 60-day average – began losing momentum and curving over just before the sell-off occurred.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Can you give me some very important commodity trading tips that I can use to trade in commodities? Had a nice experience with the type of teaching and especially with the notes that made the learning a lot easier.

- The technical analysis definition describes it as disciplines in trading used in the evaluation of investments and identifying trade opportunities.

- Theorizing that most recent price data is more important to the immediate future of the market than is older price data is often true, but can certainly be a trader’s demise if he or she is not careful.

- Both the flag and the pennant are always spotted at the end of the flag pole, or at the end of a sharp directional trend.

- There are those who believe that price movement is completely random and completely unpredictable.

- Each method has advantages and disadvantages where the distinct differences between the two approaches dictated how traders approach their analysis.

BigCharts.com provides a free charting service through its internet site (), which contains charting tools for constructing several varieties of moving averages. The daily and weekly bar charts on the BigCharts.com Web site can be modified to the time frame that best suites the trader. Included in this chapter are a number of BigCharts.com stock charts, and the buy or sell signals they generated based on the crossover method using the 30-day 60-day moving average.

Notice that the left shoulder seen alone can also be viewed as a forming flag. As the left shoulder finds its end, prices again rally, this time to a new high which will become the head of the pattern. After the high peak or head of the pattern is formed and prices have retraced back down, again prices will rally to near the same level as the left shoulder to form the right shoulder. Essentially, within an upwards trend prices have attempted to rally three times and each rally has seen limited success, or in other words has been rejected by the sellers.

The reason for this is simple; they are considered by most analysts the most basic and core trend identifying indicators. As its name would suggest a moving average calculates an average of price range over a specified period. For example, a 10 day moving average gathers the closing prices of each day within the 10 day period, adds the 10 prices together and then of course divides by 10.

Forex technical analysis and forecast: Majors, equities and commodities – FXStreet

Forex technical analysis and forecast: Majors, equities and commodities.

Posted: Fri, 28 Apr 2023 08:37:08 GMT [source]

Technical analysis is often used by professional analysts in combination with other types of research. The decisions made by retail traders could be only based on the price graphs and related statistics. However, equity analysts hardly depend on only technical or fundamental analysis only. We can apply technical analysis to any security that has past trading data. In technical analysis the lows and highs of the trend are identified by their appropriate names, which are support and resistance levels respectively. These levels are the areas where most traders are willing either to buy or sell an asset.

Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. Litecoin continues to shape a lower high and a lower low as can be seen in H4 where it already broke the H4 support area and is preparing for a retest to decline further down to a support level at 140. At the moment of writing, it is still at the ranging area as seen in the graph above. When it breaks through and closes below the support level, there is a big possibility that XAUUSD will fall further down to 1724.

In general, the foundation of https://1investing.in/ analysis is to identify recognizable patterns that in turn will help you find the right time and price to enter or exit the market. In other words, Technical Analysis is basically a study in price supply and demand. This indicator helps several forex traders understand the market’s volatility by determining the higher and lower price action values. Therefore in trading strategy, a trader should focus on buy trades if the price is above the moving average.