Content

A bookkeeper is responsible for identifying the accounts in which transactions should be recorded. Assets are what the company owns such as its inventory and accounts receivables. Assets also include fixed assets which are generally the plant, equipment, and land. If you look you look at the format of a balance sheet, you will see the asset accounts listed in the order of their liquidity. Asset accounts start with the cash account since cash is perfectly liquid.

How do I start bookkeeping for beginners?

- Pick your market and niche.

- Write a business plan.

- Register your business and get insured.

- Choose your bookkeeping software.

- Set up your business infrastructure.

- Price your services.

- Find your customers.

- Understand your funding options.

Because of this, they require specific accounting methods and benchmarks that wouldn’t apply to, say, a retail store. If you’re working with a firm, you can control accounting costs by ensuring that junior accountants handle the menial tasks, and your CPA completes the hard analysis. While daunting, learning what you need to know about restaurant accounting is not insurmountable.

What’s the best bookkeeping software for small business?

You can expect most bookkeepers to maintain the general ledger and accounts while the accountant is there to create and interpret more complex financial statements. Having a separate bank account for your business income and expenses will make your accounting easier. You’ll only have one account to monitor for bookkeeping and tax purposes, and your personal income and expenses won’t get entangled with your business ones. Believe me — only having to look at one set of bank statements is a lifesaver during tax season. Small business accounting begins with setting up each account so you can record transactions in the appropriate category.

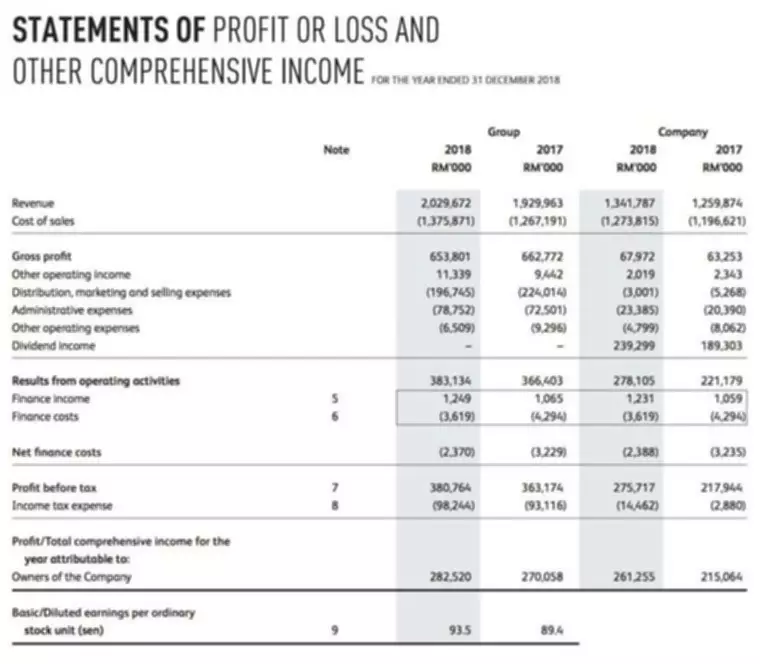

Besides keeping a record of debits and credits, the balance sheet helps you compare your business progress and metrics with the other enterprises of the same category. Maintaining healthy competition with your competitors is one of the good ways to keep your business growing. Bookkeeping is essential to the vitality and long-term success of any small business. Primarily, you need to have https://www.bookstime.com/ an accurate picture of all the financial ins and outs of your business. From the cash you have on hand to the debts you owe, understanding the state of your business’s finances means you can make better decisions and plan for the future. Again, most accounting software tackles the bulk of this process for you automatically, including generating the financial reports we discuss below.

What are the different types of accountants?

A restaurant balance sheet lists your assets, liabilities, and equity. Assets are things you own, like equipment, inventory, and straight cash. Liabilities are things like vendor bills and restaurant equipment loans. You and your accountant will work on certain bookkeeping and accounting tasks together.

Despite the cost, it can save you lots of time and money down the line. Tax obligations vary depending on your business structure. If you’re self-employed (sole proprietorship, LLC, partnership), you’ll claim business income on your personal tax return. Corporations, on the other hand, are separate tax entities and are taxed independently from owners. Sole proprietors don’t legally need a separate account, but it’s definitely recommended.

Credit

Just picturing the number of tabs I’ll accumulate in three years fills me with dread. This is best for bigger agencies with complex accounts, employees, and multiple inventories. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

A locked down accounts payable process allows you to pay your bills on time and without error, so that your inventory shipments remain on schedule. You and your accountant can use your P&L to review the total revenue and expenses of your business over a period of time. So here are the essentials of restaurant accounting and bookkeeping when it comes to reports, processes, and KPIs.

Role of Accounting in the Business

Each small business may set up its own bookkeeping system differently. This can depend on the type of company they operate and the industry in which they operate. Of course, this means that small business bookkeeping systems can also vary in terms of their breadth and complexity.

- Expenses are also referred to as “the cost of doing business”.

- Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business.

- Balance sheets also have a company’s intangible assets like customer benevolence, which can also be listed.

- These insights help businesses prepare for unexpected shifts that happen as a business grows.

- The only thing it doesn’t show is cash flow — a business can look profitable but have zero dollars in the bank.

A business with healthy (positive) equity is attractive to potential investors, lenders, and buyers. Investors and analysts also look at your business’s EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization. Equity can also be defined as the difference between your business’s assets (what you own) and liabilities (what you owe). It’s a critical component when calculating and managing your cash flow. Bookkeepers record and organize financial data for a business. To keep it simple, bookkeeping is a tactical role, while accounting is more strategic.

Restaurants have KPIs, reports, and business and tax structures that are unique to the restaurant industry. Not all industries have to deal with tips, weekly reporting periods, and hyper-sensitive labor and inventory metrics. Since accounting is complicated and the restaurant industry is unique, the professional you choose should be an expert in both. You should always reconcile accounts payable before putting your invoices into your accounting software.

Sort them into expense categories, both to keep yourself organized for tax season, and to get a look at how much you’re really spending on inventory orders versus advertising. If you were working with an in-house or remote bookkeeper, you’d probably be in touch with them to check on your books on a monthly basis. As a DIY-er, you should make a plan to sit down and commit some time on a monthly bookkeeping 101 basis to keeping your books in order. On a day-to-day basis, you might need to make decisions about when to buy something, or how much to spend on your business. Understanding how much cash you have on hand, and what else that cash needs to cover, is a key part of managing your books and your business. “Aside from revenue and expenses, the key thing is managing your cash and your cash flow.